Undoubtedly a classic in the realm of personal finance books, The Richest Man in Babylon by George S. Clason is a staple offering of finance book recommendations. The Richest Man in Babylon is most unique in its use of parables and stylized old-sounding English to communicate personal finance advice. But is the ancient civilization of Babylon actually relevant to the modern principles of personal finance? Or would you be better off with books catered to modernity rather than the ancient past?

The long and short of it:

First published in 1926, The Richest Man in Babylon is the originator of most of the common financial advice seen in personal finance books today. These pieces of wisdom are presented in the form of parables. The most notable being the story of Arkad, the fictitious Richest Man in Babylon, who was commanded by the King to educate the people of Babylon on how to become wealthy. He teaches them the Seven Cures for a Lean Purse:

First Cure: Pay yourself first

Save 10% of your income, and put this money aside. Saving money is vital for financial security and for those who have difficulty with discipline, 10% is little enough that you won’t feel restricted and be tempted to splurge. Of course if you are able, it’s preferable to save +15% so long as your budget (and discipline) allows it. With a minimum of 10% put away in savings, you will have a cushion against unexpected events. Extra savings will also provide you with the means to invest your money so it can grow. Save 10% and “thy purse [your bank account] will start to fatten at once and its increasing weight will feel good in thy hand and bring satisfaction to thy soul.”

Second Cure: Don’t confuse needs with wants

People don’t know what items are true necessities, they frequently assume they need something when in reality they only want it. In the modern era of 24/7 advertisement and social media, we are even more vulnerable to being persuaded into “needing” new products. As Arkad says, “What each of us calls our ‘necessary expenses’ will always grow to equal our incomes unless we protest to the contrary.”

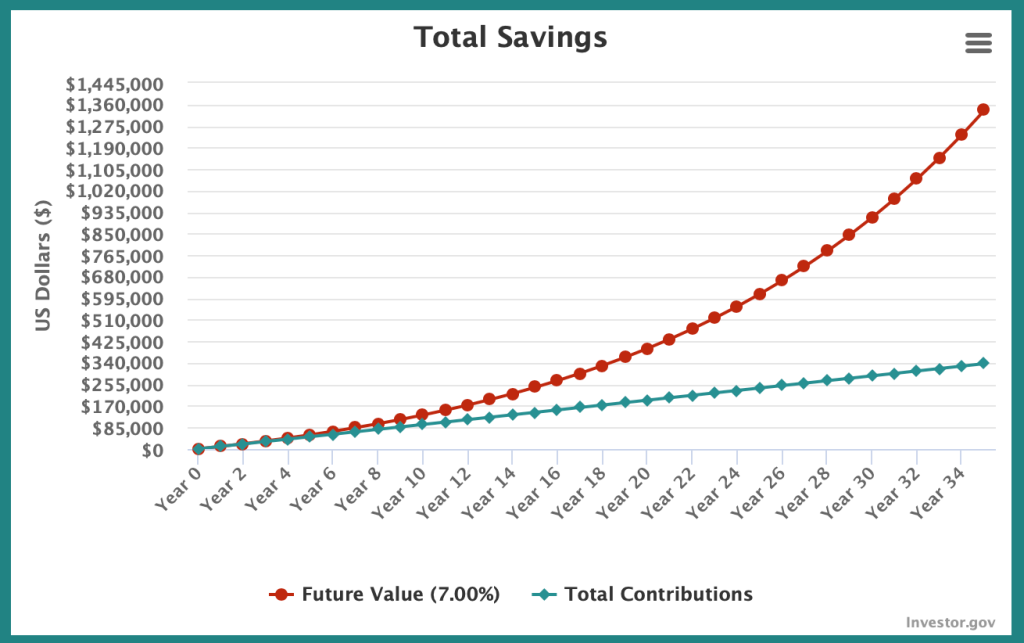

Third Cure: Take advantage of compounding

Say for example that you invest a consistent amount into an index fund with an average return of about 7% that compounds annually. Say you make $4,000 every month in income – if you’re saving 20%, that’s $800 a month. If you invest $1,000 to begin with, and then proceed to add in $800 every month for 30 years, you’re looking at $914,435.80. Give it another 5 years and you’ll have $1,337,750.61, only 35 years and a respectable retirement fund.

This growth seems miraculous because the human mind has difficulty with intuiting exponential growth, but the math makes sense. Every time the box gives you 10% more, the extra amount is counted towards the total. Through the power of compound interest you will see your wealth grow miraculously just by leaving it alone for several years. Arkad says, “Learn to make your treasure work for you. Make it your slave. Make its children and its children’s children work for you.”

Fourth Cure: Don’t fall for scams, only invest in trustworthy ventures

One of the easiest ways to make money is to promise other people that you can help them make money. Some people can actually help you gain wealth. Many can not. If I try to sell you a box that adds 10% to your money every year for a measly $500, you should question my motives. If I say the box adds 200% to your money every month, I’m probably just lying to you with false numbers. The grander the promise, the more skeptical we should be. “Study carefully, before parting with your treasure, each assurance that it may be safely reclaimed. Be not misled by thine own romantic desires to make wealth rapidly.”

Fifth Cure: Make your home an investment

Purchasing your home is generally a good financial decision. It lets you put your wealth in a property that you can later sell for a profit or rent out for an income. After paying off your mortgage you’ll have a comfortable and low cost place to live. The alternative to homeownership, renting, means your money is going towards your landlord and therefore leaving your possession. “I recommend that every man own the roof that sheltered him and his.”

Sixth Cure: Ensure a future income

Most people don’t want to have to work in their senior years. After reaching a certain age, whether that be 65 or 95, we all want to have the option to leave our jobs and spend time doing the things that bring us joy instead of worrying about making money. It’s important to set up future income for yourself, whether in the form of government pension, a 401k, or stock investments, if you want a restful retirement. This goes double for single-income households. Both for your own sake and the sake of your dependents, you should save and invest for the day you’re no longer able to work. “Therefore do I say that it behooves a man to make preparations for his family should he be no longer with them to comfort and support them.”

Seventh Cure: Invest in yourself

Education is important for all people in all stages of their lives. Education goes beyond high school and college, it is a lifelong endeavor. In today’s rapidly shifting job market and dizzyingly fast technological advancement, people who don’t strive to improve their knowledge will be quickly left behind. Learn new skills that interest you, pick up a book about something you don’t know, sign up for a course online. “The more wisdom we know, the more we may earn…that man who seeks to learn more of his craft shall be richly rewarded.”

In addition to the Seven Cures for a Lean Purse, Clason offers four additional parables in the form of stories from Babylon. Each parable communicates an important lesson about wealth and how to make it grow.

Lady luck favors men of action

There are two kinds of luck: artificial luck and naturally occurring luck. Artificial luck is fabricated by business men looking to profit from your gambling while naturally occurring luck takes more skill to recognize and offers more genuine rewards. Artificial luck is found in casinos and lottery tickets. They are purposefully controlled by a for-profit business so the odds of “getting lucky” are kept as low as the business owner can get away with. Naturally occurring luck is more abundant but less obvious. Say for instance a friend of yours invested $5,000 in video conferencing software in February 2020 when they heard Wuhan was in lockdown. Are they lucky? Or did they cleverly calculate that the risk of investing in new technology is worth it in case the virus spreads?

Naturally occurring luck is much more difficult to spot and takes much more skills to capitalize on. The more you know about something, the more quickly you can spot an opportunity. Of course, an element of chance is still involved. Before the pandemic happened, no one knew for sure how far it would spread or how long it would last. The point is not to have 100% certainty, but to increase your odds of success with good judgment, good knowledge, and good preparation (i.e. money in your bank account).

Better a little caution than a great regret

Let’s all agree that money is difficult to earn and even more difficult to keep. When it comes to investing, you should be sure that you won’t lose the money you put in. If there’s genuine uncertainty and considerable risk, it’s better to stay in cash than risk losing your hard-earned savings.

We cannot afford to be without adequate protection

No matter what your finances are doing, make sure you have some emergency funds tucked away. Just got a promotion? Excellent, that’s more money you can save for investing and the emergency fund. Kids moved out? Maybe have an emergency fund on-hand in case they come to beg for favors. About to dive head first into the stock market? Best prepare an emergency fund in case you get caught in a decade-long recession. In addition, look to procuring insurance so you and your family will be taken care of in the event of a crisis. Certainly Arkad would have recommended for you to do so, if only there were insurance companies in ancient Babylon.

Where the determination is, a way can be found

We’ve all heard it before but there is truth in this oft-repeated platitude. Where there’s a will, there’s a way. In order to achieve something difficult and meaningful, we must first imagine it, plan it, and then believe in our plans though to put it into action. If you’re not willing to throw your full effort behind a challenge, then you’ve already lost.

What makes The Richest Man in Babylon unique?

Unlike the other personal finance books I’ve been able to get my hands on, The Richest Man in Babylon likes to pretend it’s not a personal finance book. The lessons are told through parables and written almost entirely in thee’s and thou’s. Some might find this approach novel and interesting, others might find it tiresome and overplayed. Stylistic liberties aside, The Richest Man in Babylon is the first book to popularize the now-widespread principles of personal finance. It’s certainly fitting that Clason opted to borrow the aesthetics of old-sounding English and the setting of ancient Babylon. If the author was looking to establish a feeling of timelessness and universality for his timeless and universal personal finance advice, then there can be no doubt that he was very successful.

Final thoughts:

The Richest Man in Babylon consolidates and codifies all the most agreed-upon principles of personal finance. Although it’s not very specific and does not provide any actionable steps (aside from saving 10% of your income), it does provide uncomplicated and uncontroversial principles that will serve you well, no matter your race, gender, creed, or country.

Of course, no book is without its flaws. Despite clocking in at only 144 pages, The Richest Man in Babylon suffers from repetition. Outside of the above-mentioned Seven Cures and the messages of the parables, the rest is repetitive reiteration of previously stated principles or story beats only tangentially related to personal finance. If you’re in the mood for some repetition to hammer important points home (save 10% of your income!!!), the novelty of old-sounding diction, a few genuinely interesting stories (I personally enjoyed the tale of Dabasir the camel merchant), and to cross a well-known book off your to-read list, then go right ahead. If you’re of the more practical among us, then it’s fine to fall back on book summaries/reviews (like this one!) to keep you in the know.

One Response

Just wish to say your article is aas astonishing.

The clarity inn your post is just spectacular and i could assume you are an expert on this subject.

Fine with your permission allow me to grab your RSS feed to keep up

too date with forthcoming post. Thanks a million and please carry on the rewarding work. https://Lvivforum.pp.ua/