Home » Recommended

Recommended

-

Jenny Xu

Jenny Xu

- -

Many finance experts are suspicious of the simplicity of the 4% rule. Certainly it makes retirement planning much easier but

-

Y H

Y H

- -

Managing your assets during early retirement requires a well-thought-out withdrawal strategy to ensure your savings last throughout your lifetime.

-

Y H

Y H

- -

Retirement planning involves a detailed consideration of factors like when to start receiving Social Security benefits. A worker can choose

In this comprehensive guide, we’ll explore these practical strategies and actionable tips to equip you with the knowledge and tools

-

Y H

Y H

- -

The simple answer is, yes, but it involves careful consideration of plan rules, potential penalties, and long-term financial implications.

-

Y H

Y H

- -

Exceptions to avoid the penalty include the Rule of 55, SEPP distributions, and withdrawals for hardships, medical, or education expenses.

-

Y H

Y H

- -

Saving money for early retirement is an essential goal that requires strategic planning and disciplined financial habits.

In a world where gender disparities still exist, financial independence is a powerful tool for leveling the playing field. Women

-

Jenny Xu

Jenny Xu

- -

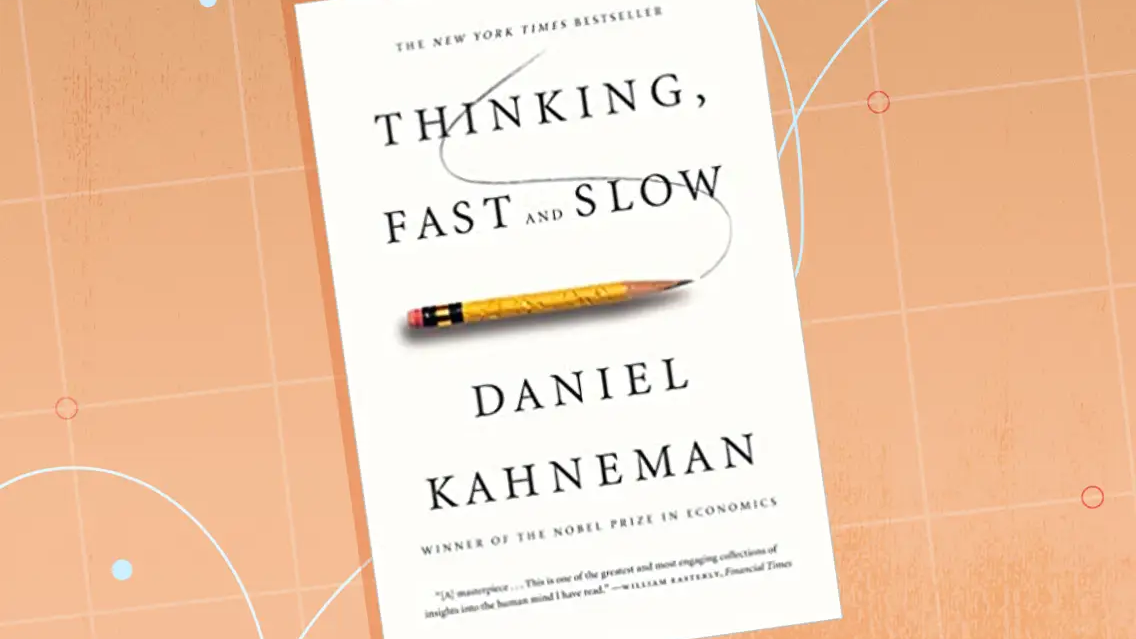

Thinking Fast and Slow approaches psychology from a broader perspective, examining the psychology of decision making in all facets of

-

Kessi

Kessi

- -

Before turning 65, you might consider COBRA, ACA marketplace plans, private insurance, Medicaid, short-term health insurance, and more.

By taking advantage of compound interest, starting saving and investing early, and developing good financial habits, it is entirely possible

-

Jenny Xu

Jenny Xu

- -

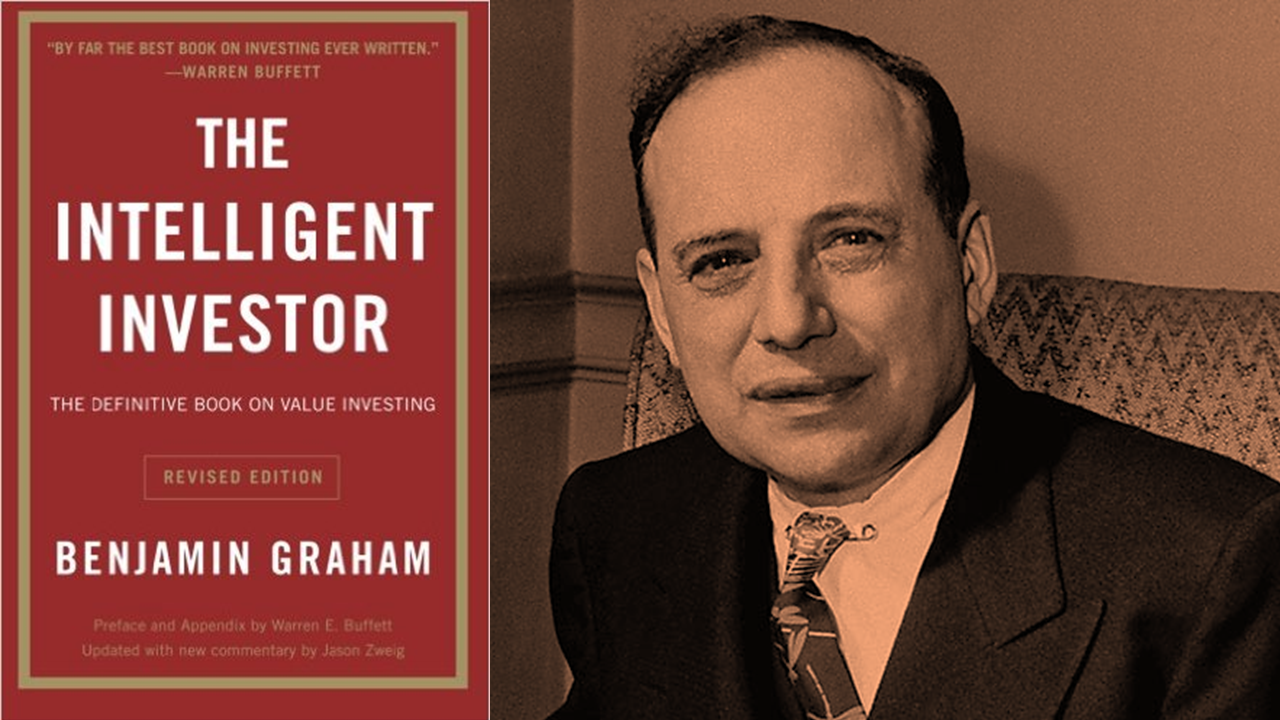

How helpful is Benjamin Graham’s dense and detailed manual to the modern investor?