The ability to earn and control one’s own money is a cornerstone of personal freedom and empowerment. For women, financial independence is not just a luxury or a nice-to-have; it’s a fundamental necessity for navigating life on their own terms.

As the saying goes, “A woman with a dollar in her pocket is a woman with a voice.” This isn’t just about accumulating wealth, but about having the agency to make choices that shape one’s life, career, and future.

In a world where gender disparities still exist, financial independence is a powerful tool for leveling the playing field. Women who are financially secure are less vulnerable to exploitation, have greater bargaining power in relationships, and can more easily pursue their passions and ambitions. This article will explore the multifaceted reasons why financial independence is so crucial for women, exploring its impact on personal well-being, relationships, career opportunities, and societal contributions. We’ll also provide practical guidance on how women can achieve and maintain financial independence, overcoming challenges and embracing the transformative power of self-reliance.

Redefining Financial Independence: More Than Money, It’s About Control and Choice

Financial independence for women is not merely about earning a paycheck or having a certain amount of money in the bank. It’s a multi-faceted concept that encompasses (Learn more about financial independence here):

- Earning Power: The ability to generate income through work, investments, or other means. This could be through a traditional job, freelance work, entrepreneurship, or passive income streams.

- Financial Literacy: Understanding fundamental financial concepts like budgeting, saving, investing, and debt management. This knowledge empowers women to make informed decisions about their money and build long-term wealth.

- Financial Autonomy: Having the freedom and agency to make choices about how to spend, save, and invest one’s money without needing to rely on others for permission or support.

- Financial Security: Having a safety net of savings and investments to weather unexpected events like job loss, medical emergencies, or economic downturns.

- Financial Goal Setting: Identifying personal financial aspirations and creating a roadmap to achieve them. This could include buying a home, starting a business, retiring early, or supporting a cause one cares about.

It’s important to note that financial independence is not about pitting women against men or rejecting traditional gender roles. It’s about empowering women to take charge of their own lives and create the future they envision for themselves. Financial independence allows women to:

- Pursue their passions: Whether it’s starting a business, traveling the world, or going back to school, financial independence gives women the freedom to pursue their dreams without being limited by financial constraints.

- Make independent choices: Women who are financially independent can make decisions about their careers, relationships, and lifestyle without having to compromise their values or goals.

- Build a secure future: Financial independence provides a sense of security and peace of mind, knowing that one can support oneself and loved ones through life’s ups and downs.

By embracing financial independence, women are not only taking control of their own destinies but also contributing to a more equitable and prosperous society.

The Profound Impact of Financial Independence on Women’s Lives

Financial independence is a transformative force that ripples through every aspect of a woman’s life, empowering her on a personal, familial, and societal level.

Personal Empowerment:

- Elevated Confidence and Self-Worth: Financial independence instills a deep sense of self-efficacy and belief in one’s abilities. Knowing that you can support yourself and make your own decisions fosters a sense of pride and accomplishment.

- Expanded Choices and Freedom: Financial independence opens up a world of possibilities. Women can pursue their passions, whether it’s starting a business, traveling the world, or investing in further education, without being limited by financial constraints.

- Resilience in the Face of Adversity: Life is unpredictable. Job loss, divorce, or unexpected medical expenses can derail anyone’s plans. Financially independent women have the resources to weather these storms, reducing stress and anxiety.

- Achieving Personal Goals and Dreams: Whether it’s buying a home, retiring early, or simply living a life of purpose, financial independence provides the means to turn aspirations into reality.

Strengthening Families:

- Equal Partnership and Decision-Making: Financial independence fosters a more equitable dynamic within relationships. Women who contribute financially have a stronger voice in household decisions, leading to greater respect and mutual understanding.

- Shared Responsibility and Reduced Burden: When both partners contribute financially, the burden of supporting a family is shared, reducing stress and promoting a more balanced and harmonious home life.

Driving Societal Progress:

- Promoting Gender Equality: Financial independence is a powerful lever for dismantling the deeply ingrained gender roles and stereotypes that have historically limited women’s opportunities. By earning and managing their own resources, women challenge the traditional notion that their worth is tied solely to domestic roles. As women demonstrate their financial prowess, they reshape societal perceptions, inspire younger generations, and pave the way for a more equitable world. The rise of financially independent women leads to greater representation in leadership roles, increased female entrepreneurship, and a more balanced distribution of power and influence. This ripple effect fosters a society where women are valued for their diverse contributions, talents, and ambitions, rather than being confined by outdated expectations.

Financial independence is not just a personal achievement; it’s a catalyst for positive change that reverberates throughout families and communities. By empowering themselves financially, women are not only improving their own lives but also contributing to a more just, equitable, and prosperous world.

Pathways to Financial Independence: Building a Strong Foundation

Achieving financial independence is a journey that requires a multi-pronged approach, encompassing career development, financial planning, and exploring entrepreneurial opportunities. Here’s a deeper dive into each of these pathways:

Enhancing Professional Skills: Investing in Your Earning Potential

Investing in yourself is one of the most valuable steps towards financial independence. Continuously upgrading your skills and knowledge not only enhances your career prospects but also boosts your earning potential. Here’s how:

- Continuous Learning: Never stop learning. Stay abreast of the latest trends and advancements in your field by attending workshops, webinars, online courses, or industry conferences. The more you know, the more valuable you become to employers or clients.(you can visit our library for more information)

- Skill Development: Identify the skills that are in demand in your industry and actively seek opportunities to acquire or refine them. This could involve taking on new projects at work, volunteering for challenging assignments, or pursuing certifications or advanced degrees.

- Networking and Mentorship: Build relationships with colleagues, mentors, and industry leaders who can offer guidance, support, and opportunities for growth. Networking can open doors to new career paths, promotions, or even entrepreneurial ventures.

- Negotiation Skills: Don’t be afraid to negotiate for fair compensation and benefits. Research salary ranges for your position and industry, and be prepared to advocate for your worth based on your skills and experience.

By investing in your professional development, you’ll not only increase your earning power but also gain the confidence and expertise to navigate the ever-changing job market.

Financial Planning: Taking Control of Your Money

Financial planning is the cornerstone of financial independence. It involves creating a roadmap for your money, ensuring that it works for you and helps you achieve your goals. Key aspects of financial planning include:

- Budgeting: A budget is a plan for how you’ll allocate your income to cover your expenses, savings, and investments. It helps you track your spending, identify areas where you can cut back, and ensure that you’re living within your means.

- Saving: Saving is crucial for building a financial safety net and achieving your long-term goals. Aim to save a portion of your income each month, even if it’s just a small amount. Automate your savings to make it easier to stick to your plan.

- Investing: Investment is the key to achieving FIRE. FIRE is all about putting your hard-earned savings to work, generating passive income that eventually replaces your need for a traditional paycheck.

- Debt Management: If you have debt, create a plan to pay it off as quickly as possible. High-interest debt, such as credit card debt, can quickly erode your wealth. Consider consolidating your debt or negotiating lower interest rates to speed up your payoff.

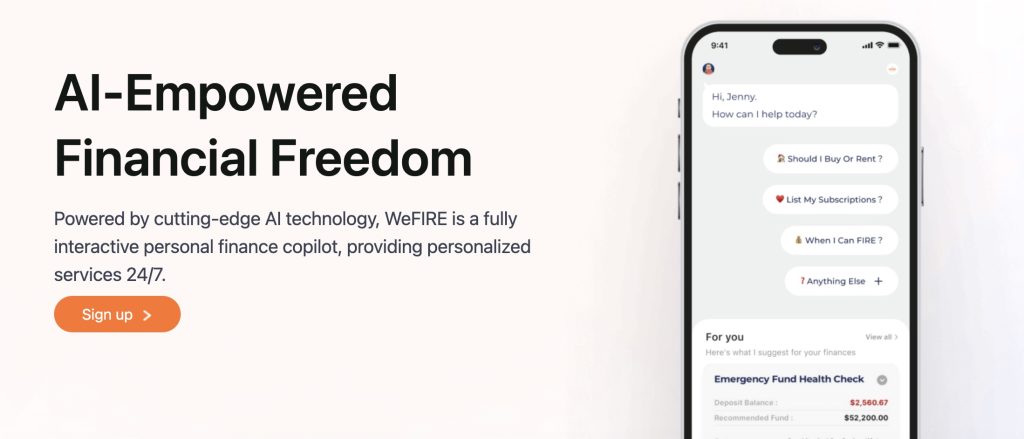

- Leveraging the WeFIRE App: This powerful tool streamlines your financial planning journey. It simplifies budgeting, optimizes your spending, offers personalized investment advice, and helps manage debt. By integrating the WeFIRE App into your financial routine, you’ll gain clarity, control, and confidence in your financial decisions, propelling you towards your goals faster and more efficiently (Click here to know more about WeFIRE app).

Financial planning is not a one-time event; it’s an ongoing process that requires regular review and adjustment. As your income, expenses, and goals change, so too should your financial plan.

Entrepreneurship and Side Hustles: Diversifying Your Income

Embarking on an entrepreneurial journey or pursuing a side hustle can be a transformative path towards financial independence. It allows you to leverage your passions, skills, and creativity to create additional income streams and potentially build a thriving business. Here’s how to navigate this exciting avenue:

- Uncover Your Passions and Talents: Self-reflection is key to identifying your entrepreneurial niche. What activities bring you joy and fulfillment? What skills do you possess that others value? Consider your hobbies, interests, and past experiences. Perhaps you have a knack for crafting, a passion for photography, or expertise in digital marketing. Identifying your strengths and passions will help you pinpoint business ideas that resonate with you and that you’ll be motivated to pursue.

- Explore Entrepreneurial Opportunities: Once you’ve identified your passions and skills, it’s time to explore potential business ventures. Conduct thorough market research to assess demand for your product or service. Look for gaps in the market that you can fill or underserved niches that you can cater to.

Consider the following avenues for entrepreneurial exploration:

Freelancing: Offer your skills and expertise on a project basis to clients. This could involve writing, editing, graphic design, web development, consulting, or any other skillset that’s in demand.

E-commerce: Sell products online through platforms like Etsy, Amazon, or your own website. This could include handmade crafts, vintage items, digital products, or curated collections.

Consulting or Coaching: Share your knowledge and experience by offering consulting or coaching services to individuals or businesses.

Content Creation: Build an audience and generate income through blogging, vlogging, podcasting, or social media.

Online Courses or Workshops: Create and sell educational content online, sharing your expertise with a wider audience.

Remember, starting small is perfectly acceptable. You can test your ideas and build momentum with a side hustle before committing to a full-fledged business.

Overcoming Challenges and Obstacles

Embarking on the journey towards financial independence is not without its challenges. Women often face unique obstacles that can hinder their progress, but with resilience and strategic approaches, these hurdles can be overcome.

Societal Biases: Challenging the Status Quo

Deep-rooted societal biases about women’s roles and financial capabilities can create significant barriers. These biases can manifest in various ways, from subtle microaggressions to outright discrimination in the workplace. Women may be underestimated, passed over for promotions, or offered lower salaries than their male counterparts.

To overcome these biases, women need to be assertive and advocate for themselves. This includes negotiating for fair compensation, seeking out mentors and sponsors, and building a strong network of supportive peers. It also means challenging stereotypes and speaking out against discriminatory practices, both in the workplace and in broader society.

Family Pressures: Balancing Act

For many women, balancing family responsibilities with career aspirations can be a daunting task. Societal expectations often place the burden of caregiving primarily on women, which can limit their career opportunities and earning potential. Additionally, family members may not always understand or support a woman’s pursuit of financial independence.

Open communication is key to navigating these pressures. Having honest conversations with partners and family members about career goals, financial aspirations, and the importance of shared responsibilities can foster understanding and support. It’s also important to set boundaries and prioritize self-care to avoid burnout.

Flexible work arrangements, such as telecommuting or part-time schedules, can be valuable tools for balancing family and career. Additionally, seeking out childcare options and delegating household tasks can free up time and energy for professional pursuits.

Psychological Barriers: Building Confidence and Resilience

Internalized societal messages can create psychological barriers that hinder women’s financial progress. Many women struggle with imposter syndrome, self-doubt, and fear of failure, which can prevent them from taking risks and pursuing their financial goals.

Building confidence and resilience is essential for overcoming these psychological hurdles. This involves recognizing and challenging negative self-talk, celebrating small victories, and seeking out positive role models and mentors. Developing a growth mindset, where challenges are viewed as opportunities for learning and growth, can also be empowering.

If self-doubt or anxiety become overwhelming, seeking professional help from a therapist or counselor can be beneficial. They can provide tools and strategies for managing stress, building confidence, and developing a healthy relationship with money.

Conclusion

The journey towards financial independence is not always easy, but it is undoubtedly worthwhile. By confronting societal biases, navigating family pressures, building a solid financial plan and sticking to it, women can unlock a world of opportunities and create a life of their own design.

Financial independence is not just about money; it’s about empowerment, freedom, and self-worth. It’s about having the agency to make choices that align with your values and aspirations. It’s about having the confidence to pursue your dreams and create a life of meaning and purpose.

As we’ve explored in this guide, the benefits of financial independence for women are vast and far-reaching. It provides a safety net against unforeseen circumstances, opens doors to new opportunities, and fosters a sense of self-efficacy and confidence that permeates all aspects of life.

Remember, financial independence is not a destination; it’s a continuous journey of growth and empowerment. It’s about taking ownership of your financial future and creating a life that is truly your own. So, embrace the challenges, seize the opportunities, and step boldly towards a future where you are financially independent and empowered to live life on your own terms.

This is just the beginning! Want to dive deeper into specific strategies for achieving financial independence? Check out these articles:

Reviewing Your Money or Your Life – Is It Possible to Have Both?

Master FIRE Money Management: Your Blueprint for Early Retirement

How to become Financially Independent as a Single Mom

Ellie Yan